To increase Ghana’s revenue, Fmr. SEC Director suggests an interest tax on Treasury Bills and Bonds.

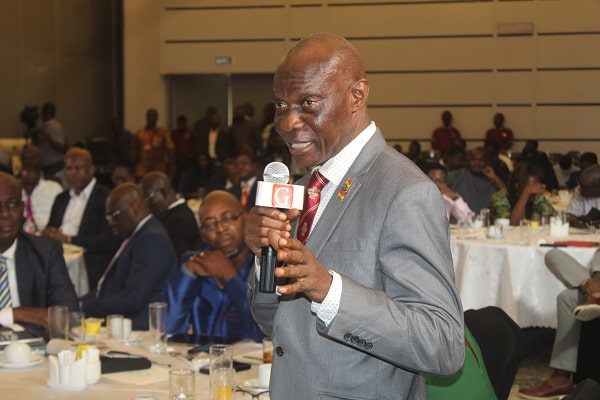

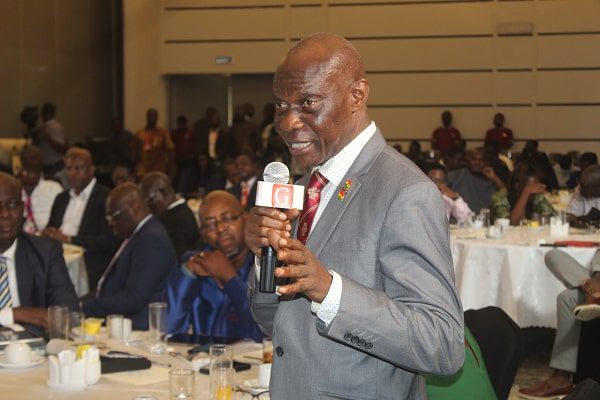

Dr. Adu Anane-Antwi, a former Director of the Securities and Exchange Commission, has recommended placing an interest tax on Treasury Bills and bonds in order to enhance Ghana’s financial position and solve the government’s limited access to finance.

The suggestion derives from disappointed company expectations regarding tax removal in the 2024 budget.

Dr. Anane-Antwi stressed the need for this policy in tax investor profits during a talk with 3Business at the Deloitte 2024 budget deliberations.

He noted that this will generate significant revenue for the state.

“The wages for an investor in financial securities is either dividends or interest. It is not right nor sound for the government to continue to tax dividends and not tax people who earn interest. A level playing field should be created. The government should start taxing interest income since dividend income is taxed”, he suggested.

Background

In recent years, Ghana has faced challenges in generating revenue. Additionally, the government has struggled to secure financing from traditional sources, such as international lenders. As a consequence, the government has been seeking novel and innovative ways to increase revenue.

Dr. Adu Anane-Antwi’s proposal to impose an interest tax on Treasury bills and bonds represents one such option. Treasury bills and bonds are debt instruments issued by the government to raise funds. These are considered relatively low-risk investments and are frequently acquired by institutional investors, such as banks and pension funds.

Potential Benefits

It would create additional revenue for the government.

It would guarantee that investors who profit from government debt pay their fair share of taxes.

It could discourage investors from investing in treasury bills and bonds.

It could potentially lead to lower interest rates for the government.

Potential Challenges

It could raise the government’s borrowing costs.

It could discourage investors from investing in Ghana altogether.

Implementation could be challenging as it would require tax code modifications.

The complexity of the proposal demands that the government carefully weigh its pros and cons before making a decision.